Crafting a Financial Strategy With Bookkeeping 5207517003

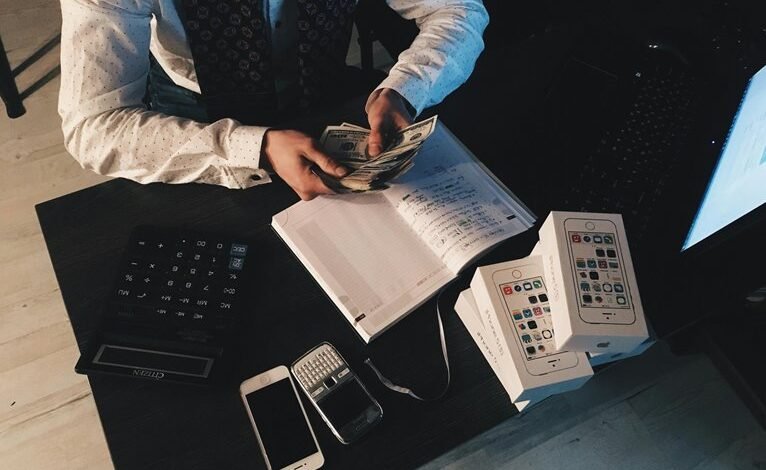

Crafting a financial strategy with bookkeeping is a critical component for any business seeking sustainable growth. Accurate records facilitate informed decision-making, enabling businesses to analyze performance and identify key trends. This meticulous approach to tracking cash flow and expenses enhances budget optimization and resource allocation. However, many organizations still overlook these foundational aspects. Understanding how to leverage bookkeeping effectively can transform financial management and drive long-term success. What strategies can be employed to integrate these practices effectively?

Understanding the Basics of Bookkeeping

Although many business owners may view bookkeeping as a mundane task, it serves as the foundation of effective financial management.

Accurate financial records are essential for informed decision-making and strategic planning. Expense tracking enables business owners to identify unnecessary costs, optimize budgets, and allocate resources more effectively.

Key Bookkeeping Techniques for Financial Strategy

Effective bookkeeping techniques play a crucial role in shaping a robust financial strategy for businesses.

Key methods include meticulous cash flow management and comprehensive expense tracking, both essential for ensuring liquidity and profitability.

Utilizing Bookkeeping Data for Informed Decision-Making

Accurate bookkeeping provides a wealth of data that can significantly enhance decision-making processes within a business.

Through meticulous data analysis, companies can identify trends, assess performance, and make informed choices.

This foundational data supports effective financial forecasting, enabling businesses to navigate uncertainties and seize opportunities.

Planning for Future Growth Through Effective Bookkeeping

As businesses strive for sustainable growth, the role of meticulous bookkeeping becomes increasingly pivotal.

Accurate financial records enable precise growth projections and informed budget forecasting, allowing organizations to allocate resources wisely.

By analyzing historical data, companies can identify trends and anticipate future needs, thereby crafting strategies that align with their long-term goals.

Effective bookkeeping fosters a foundation for financial freedom and strategic expansion.

Conclusion

In conclusion, a robust financial strategy intertwined with meticulous bookkeeping acts as a compass guiding businesses through the complexities of growth. By harnessing the precise data generated from diligent record-keeping, organizations can illuminate paths to opportunity and navigate potential pitfalls. This analytical approach not only enhances clarity in financial planning but also empowers leaders to make strategic decisions that align with their long-term vision, ensuring that every financial step taken is deliberate and purpose-driven.