SVOD, AVOD, and TVOD: What’s the Difference?

The streaming landscape in 2025 is a vibrant ecosystem, offering diverse ways for consumers to access content and for marketers to engage audiences. Three primary models dominate this space: Subscription Video on Demand (SVOD), Advertising-Based Video on Demand (AVOD), and Transactional Video on Demand (TVOD). Each model operates differently, catering to distinct viewer preferences and business objectives. This article breaks down the differences between SVOD, AVOD, and TVOD, exploring their mechanics, benefits, and implications for consumers and advertisers.

Defining the Streaming Models

Understanding SVOD, AVOD, and TVOD begins with their core structures. SVOD operates on a subscription basis, granting unlimited access to a content library for a recurring fee. AVOD provides free or low-cost content supported by advertisements, while TVOD charges users per transaction, such as rentals or purchases. These models shape how platforms deliver content and how brands can leverage them for advertising or engagement.

Each model appeals to different audience needs. SVOD attracts viewers seeking ad-free, premium experiences; AVOD draws cost-conscious users willing to watch ads; and TVOD appeals to those wanting specific content without long-term commitments. For marketers, these distinctions influence campaign strategies, targeting, and budget allocation.

The Mechanics of SVOD

SVOD platforms, like Netflix and Disney+, rely on monthly or annual subscriptions, offering unlimited access to vast content libraries. In 2025, Netflix alone boasts over 280 million global subscribers, driven by its ad-free tier and a newer ad-supported option. SVOD platforms prioritize high-quality, exclusive content—think original series or blockbuster films—to justify recurring fees, typically $8–$20 per month.

For consumers, SVOD offers convenience and variety, with no interruptions from ads in its traditional form. However, platforms like Netflix have introduced hybrid SVOD models with lower-cost, ad-supported tiers, blending subscription revenue with advertising. For marketers, SVOD’s ad-supported tiers provide access to engaged audiences, but ad inventory is limited—Netflix caps ads at 4–6 minutes per hour—requiring highly targeted, premium creative to maximize impact.

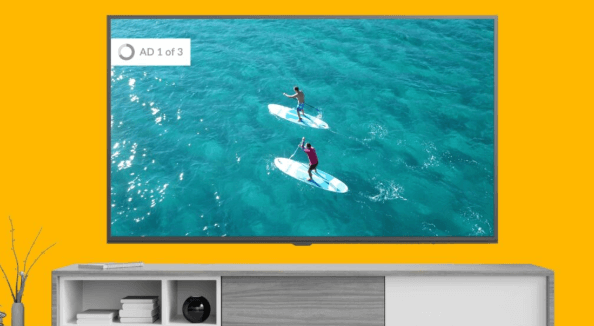

How AVOD Powers Free Streaming

AVOD platforms, such as Hulu’s ad-supported tier, Tubi, and Pluto TV, offer free or low-cost access to content, funded by advertisements. Hulu, with over 50 million subscribers, exemplifies AVOD’s appeal, delivering a robust library with an ad load of 8–12 minutes per hour. This model attracts cost-conscious viewers, particularly younger demographics like millennials and Gen Z, who tolerate ads for affordable access.

For advertisers, AVOD is a goldmine. Platforms leverage viewer data to offer precise targeting based on demographics, interests, or watch history. A pet food brand, for instance, could target Tubi users streaming animal-themed shows, ensuring relevance. AVOD’s cost-per-thousand (CPM) rates, typically $20–$40, are lower than SVOD’s premium tiers, making it accessible for brands of all sizes. However, the higher ad load demands creative that engages without feeling intrusive, aligning with the platform’s content quality.

TVOD: Pay-Per-View Flexibility

TVOD operates on a transactional model, where users pay for individual rentals or purchases. Platforms like Amazon Prime Video (for non-subscribers), Apple TV, and YouTube offer TVOD options, with rentals costing $3–$6 for 48 hours and purchases ranging from $10–$20. This model appeals to viewers seeking specific content, such as new movie releases or niche documentaries, without committing to a subscription.

For consumers, TVOD offers flexibility, ideal for one-off viewing experiences. For marketers, TVOD presents limited advertising opportunities, as the model is typically ad-free. However, platforms like Amazon integrate promotional content, such as pre-roll ads for TVOD rentals, allowing brands to reach viewers before they access purchased content. These opportunities are niche but effective for targeting high-intent audiences, such as movie enthusiasts.

Comparing Consumer Experiences

SVOD, AVOD, and TVOD cater to distinct viewer preferences. SVOD’s subscription model suits binge-watchers who value uninterrupted access to expansive libraries. A family might subscribe to Disney+ for its kid-friendly catalog, enjoying ad-free viewing for a predictable monthly cost. AVOD appeals to budget-conscious viewers willing to trade ads for free or low-cost access—think a college student streaming Hulu’s ad-supported tier for sitcom reruns. TVOD, meanwhile, attracts selective viewers, like a cinephile renting a new release on Apple TV for a weekend watch.

Each model impacts viewer engagement differently. SVOD’s ad-free (or low-ad) experience fosters deep immersion, while AVOD’s ads require careful creative to avoid disrupting enjoyment. TVOD’s transactional nature ensures high intent but limits long-term engagement, as users pay only for what they want. Understanding these dynamics helps marketers tailor campaigns to align with viewer expectations.

Advertising Opportunities Across Models

Advertising strategies vary significantly across SVOD, AVOD, and TVOD. SVOD platforms with ad-supported tiers, like Netflix, offer premium advertising opportunities due to their low ad load and engaged audiences. A 30-second Netflix ad might cost $50–$80 per CPM, reflecting its high-value environment. Creative must be cinematic, matching the platform’s polished content—think a luxury car ad during a prestige drama.

AVOD platforms, like Hulu, provide broader reach and flexibility. With CPMs of $20–$40, marketers can launch campaigns starting at $500, targeting specific demographics or genres. Formats like pause ads or interactive overlays enhance engagement, such as a QR code in a Hulu ad driving viewers to a product page. TVOD’s advertising is limited but strategic—Amazon might show a pre-roll ad before a rented movie, targeting viewers with specific interests at a premium CPM of $30–$50.

Strategic Considerations for Marketers

Choosing the right model depends on campaign goals. SVOD suits brand-awareness campaigns, leveraging its premium environment to build prestige. A luxury brand might advertise on Netflix’s ad-supported tier to align with high-end content. AVOD is ideal for performance-driven campaigns, offering cost-effective reach and granular targeting. A retailer could use Hulu to drive holiday sales with localized ads. TVOD, while niche, works for targeting high-intent viewers, such as promoting a related product before a movie rental.

Creative alignment is critical. Ads must match the platform’s tone—polished for SVOD, engaging yet concise for AVOD, and highly relevant for TVOD. Budget allocation also varies. SVOD requires higher investment for production and placement, while AVOD allows smaller budgets with scalable impact. TVOD campaigns demand precision due to limited ad opportunities, focusing on high-value touchpoints.

Challenges and Limitations

Each model presents unique challenges. SVOD’s limited ad inventory restricts scalability, requiring marketers to compete for premium slots. AVOD’s higher ad load risks viewer fatigue if ads are repetitive or poorly targeted. TVOD’s transactional nature limits ad exposure, as most content is ad-free, narrowing opportunities to pre-roll or promotional integrations.

Measurement is another hurdle. SVOD and AVOD platforms provide robust analytics—impressions, completion rates, and engagement—but integrating these with cross-channel data can be complex. TVOD’s limited ad formats offer fewer metrics, making ROI harder to assess. Privacy regulations, like GDPR, further complicate targeting, requiring compliance to avoid penalties.

Future Trends Shaping Streaming Models

The streaming landscape is evolving, driving growth across all three models. SVOD platforms are expanding ad-supported tiers to capture cost-conscious viewers, with Netflix and Disney+ leading the charge. AVOD is gaining traction with free platforms like Tubi, attracting advertisers with low costs and broad reach. TVOD remains a niche but steady market, with platforms like Amazon enhancing transactional offerings through bundled promotions.

Emerging trends are reshaping advertising opportunities. Live content, such as Hulu’s sports streams or Netflix’s planned events, boosts ad demand, offering real-time engagement. AI-driven personalization tailors ads to viewer preferences, improving efficiency across models. Shoppable ads, integrating direct purchase options, are expanding on AVOD and TVOD, with Hulu and Amazon leading innovation.

Leveraging SVOD, AVOD, and TVOD for Impact

The distinct structures of SVOD, AVOD, and TVOD offer marketers a spectrum of opportunities to reach streaming audiences. SVOD delivers premium, targeted exposure; AVOD provides cost-effective scale; and TVOD offers niche, high-intent touchpoints. By aligning strategies with each model’s strengths—crafting compelling creative, leveraging data, and adapting to trends—brands can connect with viewers effectively. As streaming continues to dominate in 2025, understanding these models ensures marketers maximize impact in a rapidly evolving media landscape.